Your Tax Dollars at Work to Save on Capital Equipment Purchase

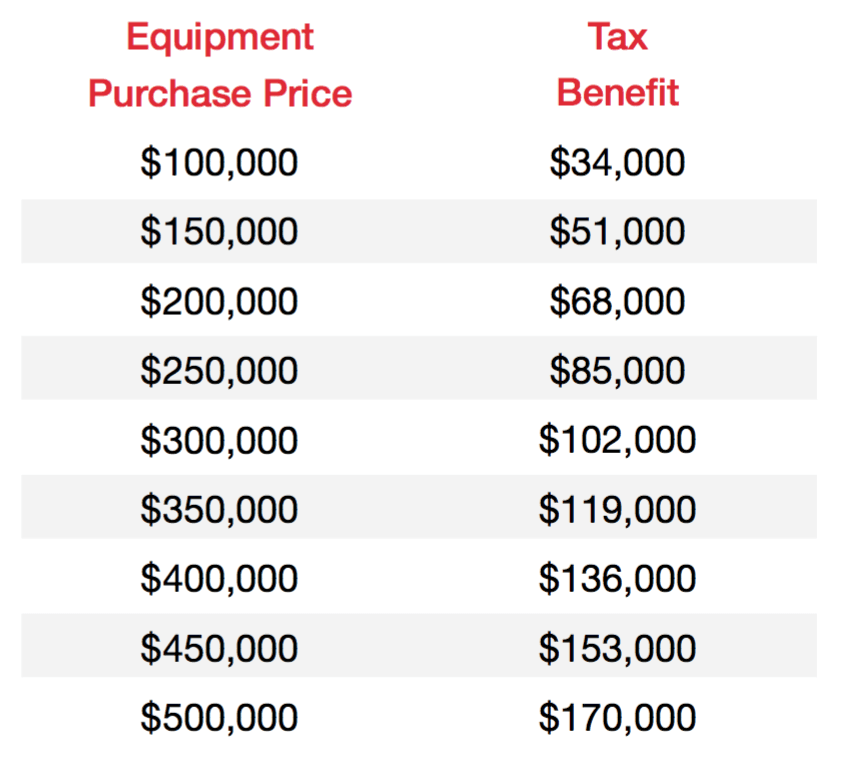

The Section 179 deduction limit is $1,050,000 for 2021.

Businesses exceeding a total of $2 million of purchases in qualifying equipment will have the Section 179 deduction phase-out dollar-for-dollar and completely eliminated above $2.62 million.

100% Bonus Depreciation will be extended through 2021. Businesses of all sizes will be able to depreciate the cost of equipment, both new and used (“new to you”), acquired and put in service.

The deadline is December 31, 2021. That’s when the new equipment or software must be up and running for you to take advantage of the deduction. Please consult your CPA or Tax Accountant for further details.

Finance Program

- Improve Workflow & Efficiency

- Capture 2021 Tax Benefits

- No Payment for 90 Days

- Program Based on:

- 3-, 4-, or 5-year term

- 100% financing

- Last payment in advance

- $1.00 Purchase Option

- Subject to credit approval

- Program ends 12/31/2021

Example

What Qualifies

- Equipment purchased for business use (e.g. machines, etc.)

- Property attached to your building that is not a structural component of the building (e.g. a printing press, etc.)

- Tangible personal property used in business

- Business vehicles weighing in excess of 6,000 pounds

- Computers

- Software

- Office Furniture

- Office Equipment

- Partial Business Use

- Certain improvements to existing non-residential buildings (e.g. alarm and security systems, etc.)