New Capital Expense Rules for 2018

Don’t Miss Out on the Advantages of Section 179.

When it comes to taxes, you don’t want to leave any money on the table. But you have to know how the latest tax reform rules can be put to work for you.

The big tax reform bill that passed in late 2017 contains a host of provisions that can bring significant advantages to small businesses, especially companies such as label and package printers and converters whose success can hinge on keeping pace with changes in technology. This is especially important as more and more converters upgrade flexo presses or add digital platemaking or digital printing technology to help gain or maintain a competitive advantage. Until now, the big challenge has been marshaling your financial resources in ways that let you bring new technology into your business and which also makes sense when tax time rolls around. The new tax changes can make this easier, especially a provision known as Section 179.

The big tax reform bill that passed in late 2017 contains a host of provisions that can bring significant advantages to small businesses, especially companies such as label and package printers and converters whose success can hinge on keeping pace with changes in technology. This is especially important as more and more converters upgrade flexo presses or add digital platemaking or digital printing technology to help gain or maintain a competitive advantage. Until now, the big challenge has been marshaling your financial resources in ways that let you bring new technology into your business and which also makes sense when tax time rolls around. The new tax changes can make this easier, especially a provision known as Section 179.

Starting this year, Section 179 lets you expense up to $1 million in business property purchases, twice the former limit of $500,000. This is especially advantageous when considering a new digital press and related equipment. Previously, spending for business and office equipment, vehicles and the like would be depreciated over several years, spreading out the tax benefit. But what Section 179 does is let you take the tax break for the year the newly acquired property is placed in service. This means you can install a new device as late in the year as December, and as long you can document that it is in regular operation by the end of the month, you are good to go.

Small Business Friendly

One of the interesting parts of Section 179 is an “eligibility phase out” intended to limit its use to small businesses. The eligibility actually extends up to $2.5 million with the caveat that if you spend more than $2.5 million on business property the $1 million deduction will be reduced on a dollar-for-dollar basis. Still, this enables many businesses to garner some significant tax deductions for buying equipment that can help bring in new capabilities and services than can be key differentiators in local markets.

For example, a label and packaging printer or converter can more easily invest in a new digital plate maker and plate processor that would streamline workflow and let more jobs be produced in a shift. Or possibly even acquire a new digital label press to take advantage of the growing market for short-run or customized packaging. And, because the benefit is not limited to new equipment, a used press or even a used delivery truck can be made part of the deduction. Similarly, new and upgraded alarm, heating and air conditioning systems, as well as roof improvements can also be included. So as you ponder the potential, take a broad look at your business needs and what will help make your business better. Then make the investments that make sense for your company from daily operations to infrastructure to tax planning. Of course, be sure to discuss you plans with your tax professional to make sure you maximize your benefits under Section 179.

But Wait! There’s a Bonus!

You probably aren’t expecting a bonus to arrive on top of this, but for a limited time a First-Year Bonus Depreciation limit is also improved. A bonus depreciation, similar to Section 179, lets you immediately expense capital purchases instead of depreciating them over several years. That starts this year, 2018, and lets you depreciate 100 percent of a qualified asset purchase price over the next five years. This can now be used for both new and used equipment put into service starting in 2018. To put this in context, bonus depreciation is normally used for relatively short-lived capital investments that have a useful life of 20 years or less. This new bonus allowance will decline starting in 2022, so the sooner you can take advantage of this the more meaningful it can be for your business. When you do the math, you can quickly see that in most cases the First-Year Bonus Depreciation changes that landscape so you can make investments that can help your business grow and be more profitable.

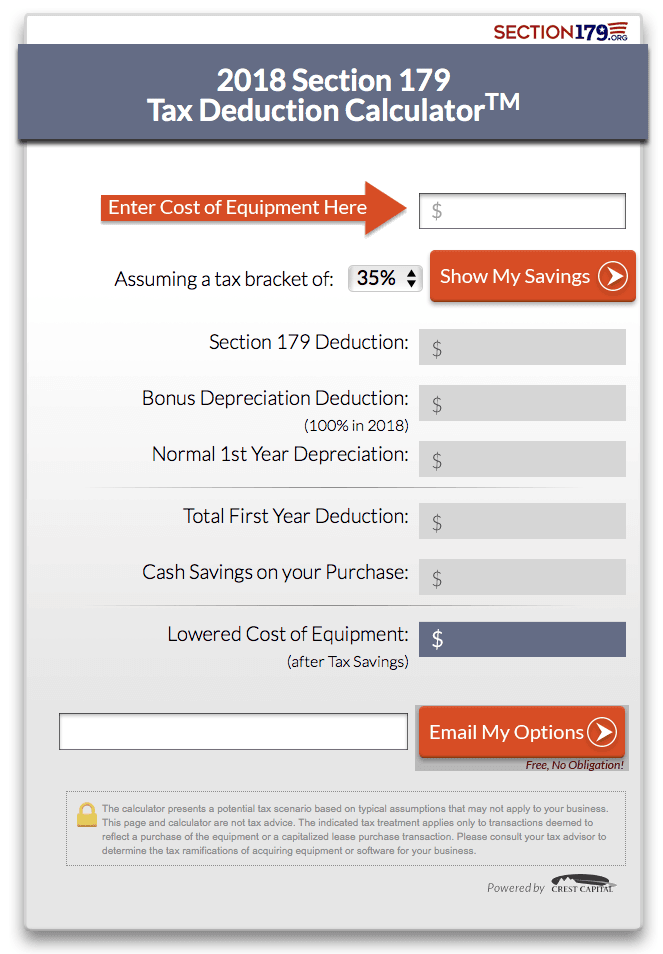

You can find more details and even a tax calculator online at http://www.section179.org and at http://www.section179.org/section_179_calculator/. As noted, be sure to work with your accountant or other tax professional to make sure you use this attractive new tax advantage as effectively as possible.